Edge AI: The Revolution Within GenAI

As artificial intelligence becomes an integral part of our lives, a new frontier called Edge AI is emerging, promising to enhance AI capabilities even further.

Fast fashion disruptor Shein is shaking up the Spanish market, outpacing European giants like Zara in both online searches and growth. Despite ethical concerns, Shein’s low prices and strategic focus on smaller cities are winning over young professionals.

A new report from Intent HQ ‘Discovering The Shein Effect In Spain‘, based on market insights from Intent HQ’s Insights Store, reveals Shein’s 67% y on y growth and potential to overtake Primark within two years.

Shein, the Asian low-cost fashion giant has arrived in Spain to stay and is proving to be a strong competitor to the European incumbents of affordable fashion. In the last year, it has achieved revenues almost higher than those of Inditex despite the controversies surrounding the brand about environmental policies, human rights, or problems related to Intellectual Property. Shein is gaining ground in the European market exponentially and local brands must evaluate their strategies to keep playing the game.

Thanks to a study carried out by Intent HQ using data and market insights extracted from its Market Explorer platform, we know that Shein is surpassing the Spanish fashion retail market in total spend and in the number of transactions. In addition, the platform lets us know that its buyers are mostly young professionals with lower incomes and that Shein is seeing double and even triple-digit growth in smaller cities with less access to large shops, such as La Rioja, Cáceres, and the Canary Islands.

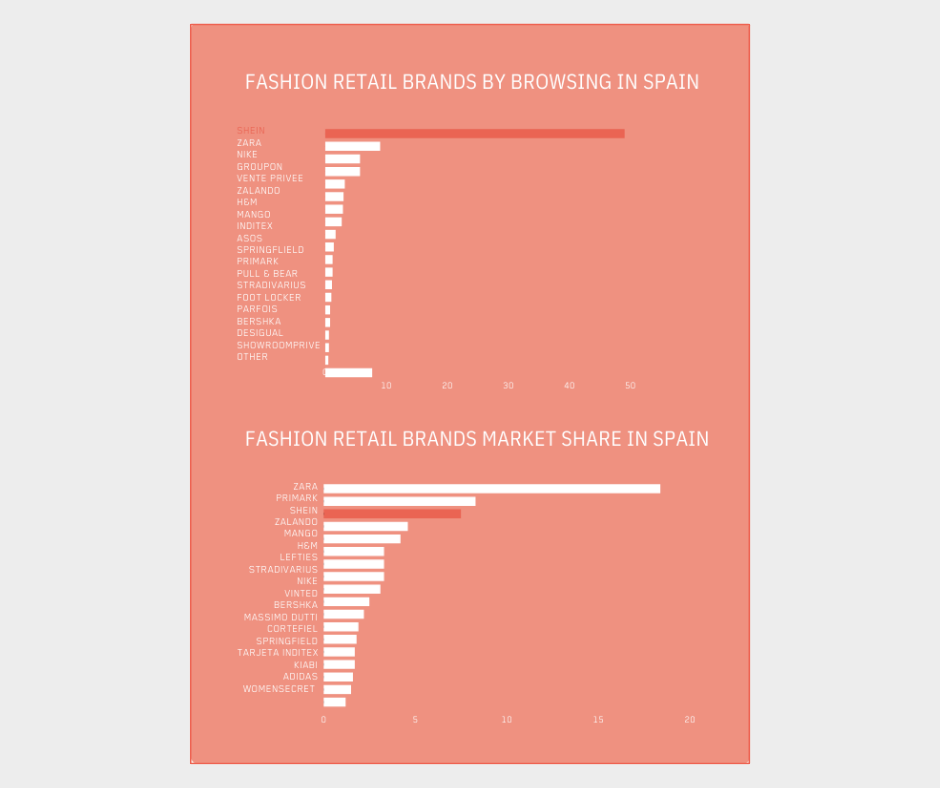

As you can see in the following graph taken from Intent HQ’s Market Explorer, Shein is a significant threat to traditional retailers in Spain and is positioned as the most browsed fashion retail brand online in the country.

Market Explorer also allows us to identify that while tickets at Shein are lower in value, shoppers more frequently transact at Shein than at other local fashion retail brands. As a result, Shein customers in Spain spend 7.5 percent less per transaction than the average Spanish fashion retail shopper but make 28.7 percent more purchases in the sector than the average Spanish consumer. The result is a 19.3 percent higher total spend compared to that of the average fashion retail consumer.

While Shein’s customers in Spain continue to shop at Zara as their first choice, this might not be the case for much longer.

Thanks to the market insights from Intent HQ’s Insights Store, we can see that Shein has witnessed 67 percent sales growth between Q1 2022 and Q1 2023, which means that if it keeps going like this, it could overtake Primark in two years and Zara in three.

The above analysis demonstrates how Intent HQ’s Market Explorer can help brands, retailers and e-commerce understand the customer and the market dynamics better. The market insights provided in Market Explorer are based on what consumers actually do, and not what they say they do, thus differentiating it from other similar products on the market. It allows you to create easy segmentation strategies, increase revenue, and make intelligent brand positioning decisions.

Learn more about Market Explorer here or download the full report above.

Select language: