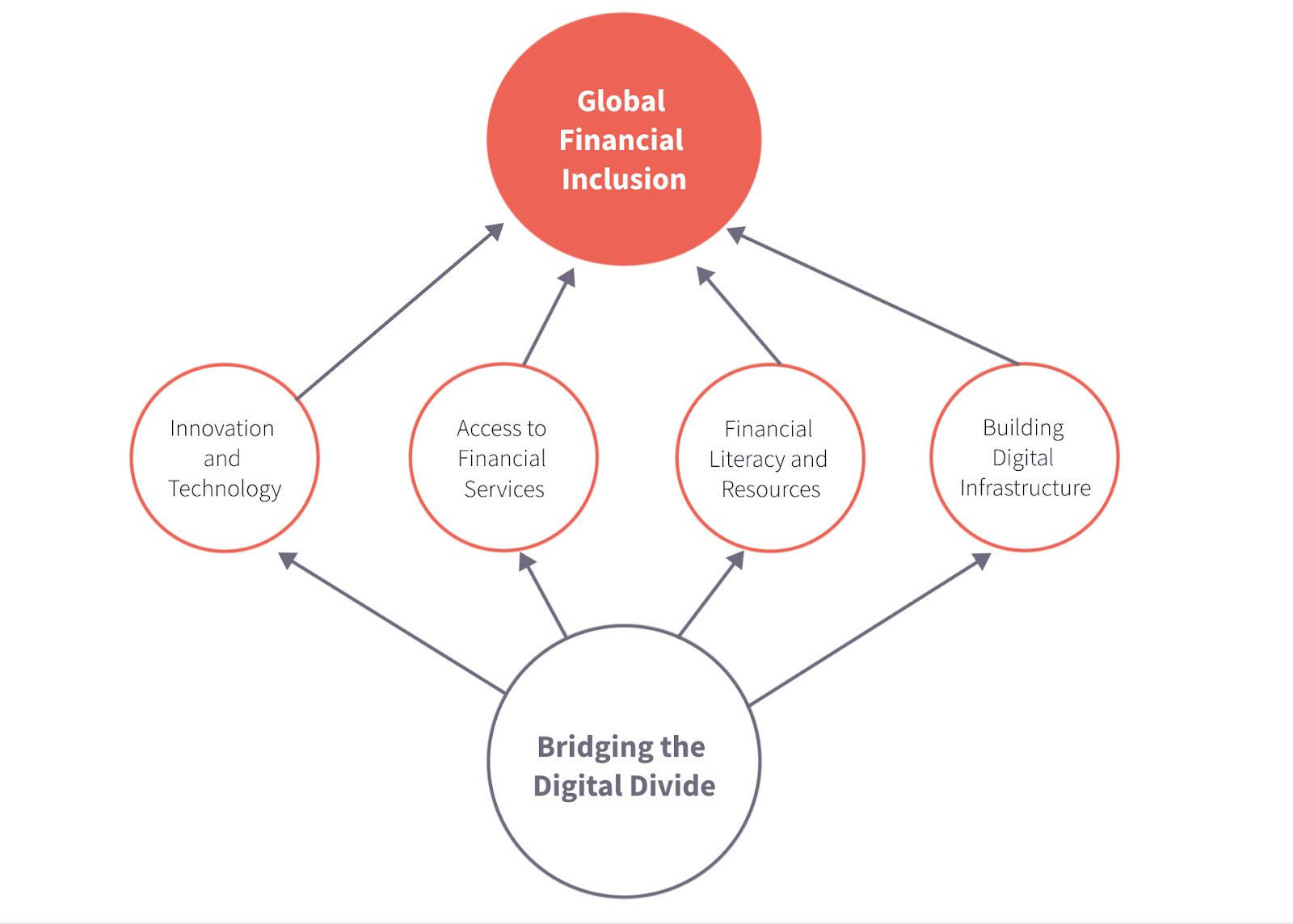

One of the most significant challenges facing the world today is global financial inclusion. As of 2022, approximately 1.4 billion people worldwide still remain unbanked, hampering their ability to access economic opportunities and exposing them to risks such as disease, modern slavery, and permanent debt. One of the biggest contributing factors to the gap in global financial inclusion is the digital divide. In many cases, individuals without access to digital technologies or lacking digital literacy skills face significant barriers to financial inclusion. They are unable to access online banking services, make digital payments, or benefit from fintech innovations that enhance financial access.

Addressing Challenges and Expanding Access

Over the past decade, increased access to mobile phones has caused a sharp rise in access to digital monetary transfer services, a huge leap forward in financial inclusion. However, further efforts are needed to broaden access to a wider range of financial services, such as microloans, insurance, and borrowed funds, both at the individual level and for Micro, Small, and Medium Enterprises (MSMEs). These services play a crucial role in narrowing the global financial inclusion gap by empowering individuals and businesses to mitigate risk, invest in education or ventures, build assets, and establish a stable financial foundation. Historically, enabling access to advanced financial services for the unbanked and underserved has been challenging. At the center of this challenge is the requirement for individuals or businesses to have permanent addresses, credit scores, and other financial assets to access more advanced financial services. This creates a circular issue where having one prerequisite depends on already having the other.

AI and ML Innovations in Action

Excitingly, recent developments in AI and ML technologies offer the potential to break this cycle and broaden access to a wealth of financial services. Innovations such as federated learning and Edge AI allow access to previously untapped reservoirs of data, using hyper-local, real-time data to create predictive models that eliminate the need for a financial history. The use of these predictive tools breaks the circular nature of accessing financial services and has the potential to empower millions of unbanked and underserved individuals globally.

This paper explores the future potentials and applications of these technologies to increase global financial inclusion. Firstly, we will explore the interconnected nature of global financial inclusion and the digital divide, paying close attention to the types of financial services that are currently available to unbanked individuals. Next, we will explore the exciting advancements that have been made in the fields of AI and ML and the myriad applications these tools have in the financial services industry. Finally, we will conclude the paper with a deep dive into the use case of Edge AI and microloans, exploring the challenges of alternative credit scoring and how AI and ML tools can solve many of these challenges.

Download your free copy today: